does cash app report to irs bitcoin

Beginning this year Cash app networks are required to send a. If you wish to convert it to cash you should use a bitcoin ATM.

.png)

How To Do Your Cash App Taxes Coinledger

Make sure you fill that form out.

. The taxpayer reports the 266 value of Bitcoin Cash as proceeds and 95 of Bitcoin cost basis as Bitcoin Cash cost basis. Cash App does not report your total Bitcoin cost basis gains losses to the IRS or on this form 1099-B. Just like with any cryptocurrency exchange PayPal users who sell or otherwise dispose of their cryptocurrency on the PayPal cryptocurrency hub will incur.

It is your responsibility to determine any tax impact of your bitcoin transactions on Cash App. Payments for goods and services totaling 600 or more in a year must be reported on Form 1099-K starting January 1 2022. Previous rules for third-party payment systems.

Does Square Cash App report to the IRS. According to Cash Apps FAQ anyone who trades Bitcoin will get a Form 1099-B which Cash App will send to the IRS. Does The Cash App Report To IRS.

In the United States if you make less than 1000 with a line of income you dont have to report it to the IRS. Now cash apps are required to report payments totaling more than 600 for goods and services. Does PayPal report crypto to IRS.

Cash App does not provide tax advice. Some assets such as the. Does Cash App report bitcoin to IRS.

Does Cash App report to IRS. Whenever you receive a 1099. Cash App may charge a fee when you buy or sell bitcoin.

So if you made less than 1000 with Bitcoin last year you have nothing to worry. Anyone who trades Bitcoin will get a Form 1099. You can also access your transactions CSV from your desktop browser at httpscashappaccount.

Does Cash App report to the IRS. As of January 1 2022 there are new rules for cash apps and electronic payment systems to report business transactions to the IRS. Any 1099-B form that is sent to a Cash App user is also sent to the IRS.

Any users transacting with Bitcoin via Cash App will receive a 1099-B form. Select the 2020 1099-B. Yes the Cash app falls under the IRS.

Cash App will provide you with your Form 1099-B based on the Form W-9 information you provided in the app. Starting January 1 2022 if your Cash for Business account has 600 or more in gross sales in the 2022 tax year it will qualify for a Form 1099-K and Cash App is required to report it to the IRS. As a law-abiding business Cash App is required to share specific details with the IRS.

Cash App reports to the IRS. Remember there is no legal way to evade cryptocurrency taxes. For Bitcoin sales they dont report basis just total proceeds.

The solution is straightforward. A seller would only need to report income to the IRS if they had received 20000 worth of payments per year and there were at least 200 transactions on their account. Tap on the profile icon.

So if you want to do it right theyve sent incomplete info to the IRS. Personal Cash App accounts are exempt from the new. This includes any foreign currency that is used to pay for.

The initial value of Bitcoin Cash was 95 of the Bitcoin. Tax Reporting with Cash For Business Cash App for. Tax is based on capital gains not total sales.

The answer is very simple. Cash App reports the total proceeds from Bitcoin sales made on the platform. The IRS says that companies conducting transactions in currency other than the US dollar must report them to the IRS.

Cryptocurrency Tax Calculator Forbes Advisor

U S Treasury Calls For Irs Reporting On Crypto Transfers Above 10 000 Protocol

Cash App Business Account Your Complete 2022 Guide

Does Cash App Report Personal Accounts To Irs Cash App

Cash App Get 10 Back On Your Purchases In Bitcoin Up To 22 50 Back Maximum Doctor Of Credit

Cash App Won T Have New Taxes In 2022 Despite Claims

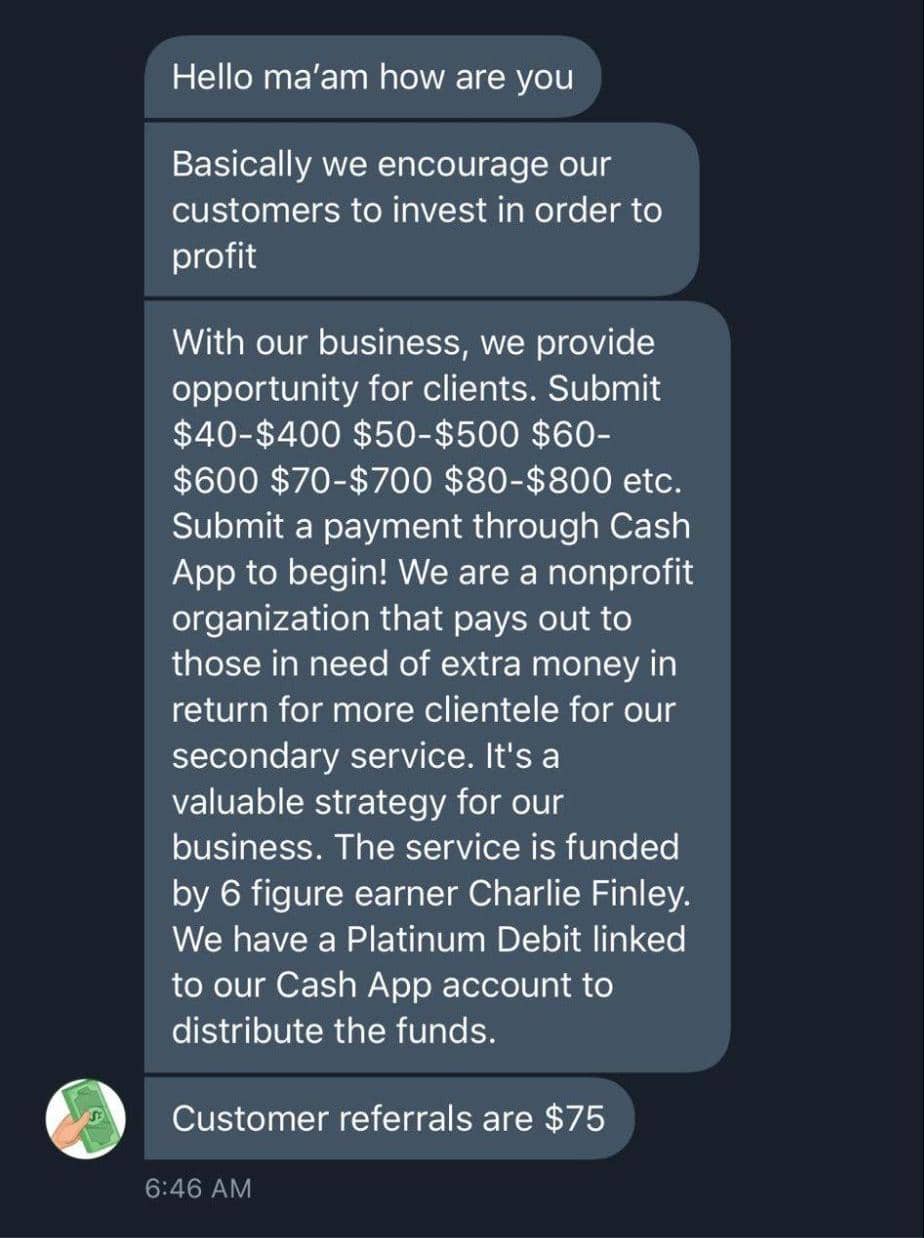

The 14 Cash App Scams You Didn T Know About Until Now Aura

Block S Cash App Allows Users To Get Paid In Bitcoin Automatically Nyse Sq Seeking Alpha

Does Cash App Report To The Irs

How To Do Your Cash App Taxes Coinledger

Be Sure To Report Cryptocurrency Activity On Your Tax Return Don T Mess With Taxes

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How To Find The Cash App Bitcoin Wallet Address Ultimate Guide Frugal Living Coupons And Free Stuff

New Crypto Tax Reporting Requirements In The 2021 Infrastructure Bill

Venmo Paypal And Cash App To Report Payments Of 600 Or More To Irs This Year What To Know Fox Business

Infrastructure Bill Cracks Down On Crypto Tax Reporting What To Know

Cryptocurrency Taxes Guide 2022 How Why To Report Your Profits

Does Cash App Report Personal Accounts To Irs New 2022 Tax Rules